South: How will tax changes affect landlords over the next five years? asks Romans

31% of landlords believe that the new rules around mortgage interest tax relief will hit them the hardest out of all the buy-to-let changes that have been announced or introduced recently, according to a Simply Business poll.

It’s true that landlords have been affected by a number of new tax rules recently, and more are seeking the advice of financial advisers and experienced letting agents to ensure their investment is as sound as it can be.

Despite the tax changes, 39% of Romans’ landlords still see property as being the safest investment and a further 25% are using their investment as their pension, according to Property Academy’s latest Landlord Survey.

“There is still a lot of long-term profitability in the buy-to-let marketplace,” commented John Sumner, regional lettings director at Romans. “The demand from tenants is higher than ever due to the lack of housing available, so rents are rising alongside house price rises, resulting in a very buoyant marketplace.”

What is the mortgage interest tax relief?

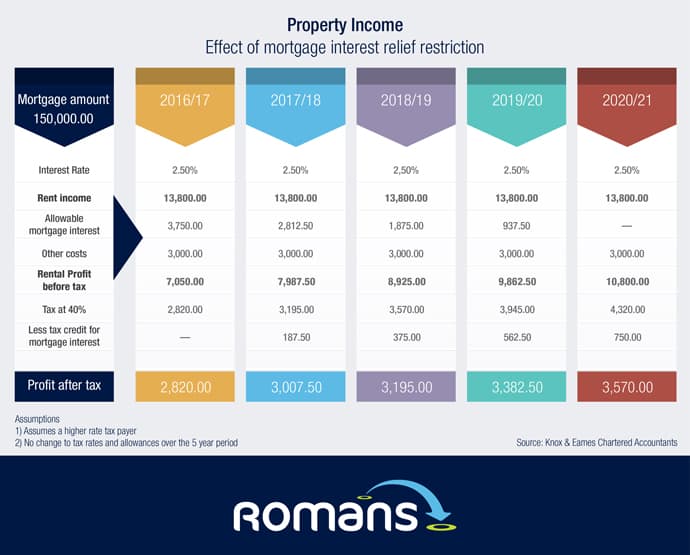

From April 2017, HMRC will begin phasing in changes which will eventually see landlords pay tax on the gross rental income, less allowable expenses that they generate from their properties. However, they will no longer be able to deduct the cost of mortgage interest against their rental income but instead will benefit from a tax credit equal to 20% of the mortgage interest.

With over two thirds of property in the residential rental sector being mortgage free, only 31% of landlords will actually be affected by the mortgage interest tax relief change. Plus, this only affects landlords who are higher rate tax payers or become higher rate tax payers as a result of this change.

Buy-to-let tax implications

Some of the current tax implications involved when buying investment property are:

• Higher Stamp Duty on purchase of property

• Tax on rental income

• Tax on sale of property (Capital Gains Tax)

There are also many expenses, on which the landlord could receive tax relief, including:

· Letting agents’ fees

· Accountants’ fees

· Buildings and contents insurance

· Interest on property loans – restricted from April 2017

· Maintenance and repairs to the property (but not improvements)

· Utility bills

· Rent, ground rent, service charges

· Council Tax

Property income calculator

Tax on property letting is becoming an increasingly-complex area and the new restrictions on mortgage interest relief are perhaps the most significant to the property investor.

Romans always recommends seeking professional advice to ensure that all relevant claims are made and that tax is correctly calculated and declared to HMRC. Penalties for inaccurate or missing submissions can be substantial.

Sumner said: “The property income tax calculator is for indicative purposes but does demonstrate the impact that the restriction of mortgage interest has on income tax and hence investment returns.”