South: LSH agrees MBO from Atkins

Lambert Smith Hampton (LSH), with regional offices in Fareham and Southampton, has exchanged contracts for a management buyout (MBO) from parent company Atkins to take the business private. The MBO, led by chief executive Mark Rigby and supported by Bank of Scotland Corporate, sees LSH return to private ownership and comes on the day the firm reports its 2007 year-end results, with profits increased by 90 per cent and turnover increased by 14% on 2006.

The management has agreed to purchase LSH, held as a wholly-owned, non-core investment subsidiary by Atkins, for £46.5 million. Contracts were exchanged today.

Mark Rigby, chief executive, said: “LSH is a dynamic and successful business which is performing strongly and delivering significant growth. We have completed this deal to give LSH control and ownership of its own future, and to make that future an even better one for our staff and clients. We’re delighted with the deal and to be back running our own ship.”

In addition to Mark Rigby, the MBO involves chairman Bruce Brown, and National Head of Investment, Ezra Nahome, the firm’s leading fee-earner. This Management team has taken control of LSH in the first phase of changing ownership of the business. In phase two, ownership will be spread more widely within the firm.

“Our first priority was to achieve a clean, swift and seamless exit from Atkins with minimal disruption to the business and services to our clients,” Rigby added. “This move is immensely positive for LSH and will be a significant factor in helping us to achieve our targets for growth.”

LSH’s 2007 year-end results report operating profits before tax up from £4.9 million to £9.3 million (a 90% increase) based on turnover of £81.8 million. Margin has also significantly improved from 6.8% in 2006 to 11% in 2007.

Performance highlights in 2007 include key re-appointments by the BBC, Hertfordshire County Council and Essex County Council for professional estate services. The appointments came as LSH increased its national client base and extended integration of service lines, resulting in 35% of turnover being derived from national contracts.

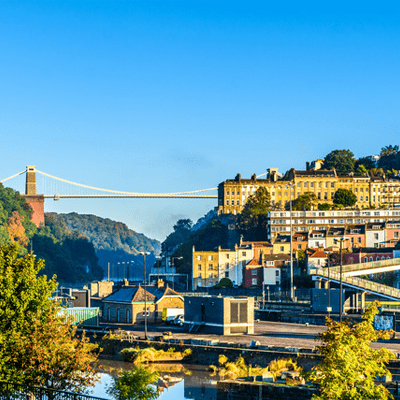

LSH also purchased two leading commercial property businesses in 2006-7 to add to its national network: Poolman Harlow in Swansea (April 2006) and Young & Butt in Fareham and Southampton (November 2006).

Further highlights saw strong growth in the Rating, Professional and Building Consultancy Divisions alongside increased revenues in Industrial Agency and Office Agency. Income from LSH’s Consultancy Divisions (Property Management, Professional, Rating, and Building Consultancy) represented 59 per cent of total income, continuing LSH’s robust balance between Consultancy and Transactional income.

Bank of Scotland Corporate (Integrated Finance) has provided funding in support of this transaction. Andy Powell, Director of Integrated Finance at Bank of Scotland, commented: “The MBO of LSH is another high profile transaction for Integrated Finance and we are extremely pleased to be investing in the business. LSH has incredible strength and depth in its market and we look forward to working with the management team to grow the firm.”

LSH welcomes Clive Williams, a former senior partner at Ernst and Young, who joins the company as non-executive director. LSH was advised by Baker Tilly (led by Rob Donaldson, Head of M&A and Private Equity) and Berwin Leighton Paisner. WS Atkins was advised by PwC Corporate Finance.